Qualcomm Reports Strong Fourth Quarter Results Exceeding Expectations

Highlights

- Revenue: $11.3B (exceeded guidance)

- Non-GAAP EPS: $3 (above guidance)

- QCT Revenue: $9.8B (up 9% sequentially)

- Automotive Revenue: surpassed $1B (17% YoY growth)

- Fiscal '25 Non-GAAP Revenue: $44B (up 13% YoY)

- Automotive Revenue Growth: 36% YoY

- IoT Revenue Growth: 22% YoY

- Free Cash Flow: $12.8B (record)

Despite prevailing market challenges, Qualcomm's fiscal fourth quarter results have outstripped expectations, underscored by impressive figures across various segments.

Robust Performance Across Segments

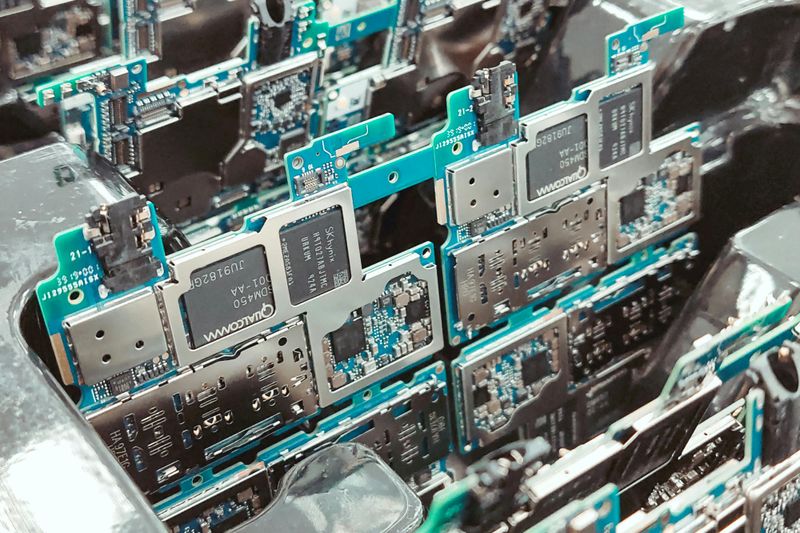

Qualcomm reported fourth-quarter revenue of $11.3 billion and non-GAAP earnings per share (EPS) of $3, both figures surpassing the high end of their guidance. The semiconductor giant's QCT (Qualcomm CDMA Technologies) revenue reached $9.8 billion, representing a sequential increase of 9%. Notably, this success was fueled by heightened demand for Snapdragon-powered premium Android handsets and continued growth in automotive and IoT (Internet of Things) sectors.

The automotive segment proved particularly vibrant, achieving standout momentum with quarterly revenues exceeding $1 billion, marking a 17% year-over-year boost. IoT also significantly contributed, showcasing a 22% annual increase, as Qualcomm's Snapdragon Digital Chassis and various IoT advancements solidified its market position.

Strategic Growth Reflected in Annual Figures

For the fiscal year 2025, Qualcomm's non-GAAP revenue reached $44 billion, exhibiting a robust 13% year-over-year growth. A major highlight was QCT's record annual revenue of $38.4 billion, demonstrating an annual jump of 16%. Automotive and IoT revenues were pivotal, with AI-driven smart glasses emerging as a novel and promising field. The company's non-Apple QCT revenues grew by 18%, highlighting its expanding footprint beyond traditional partnerships.

Moreover, Qualcomm's free cash flow remarkably hit a record $12.8 billion. Consistent with its strategic imperatives, nearly 100% of this was returned to shareholders via repurchases and dividends.

Conclusion

Qualcomm has positioned itself as a formidable player in sectors beyond mobile handsets, demonstrating resilience and strategic foresight. The company's adept execution across diversified growth vectors, including automotive, IoT, and nascent AI-driven platforms, provides a vivid narrative of its future trajectory. Investors are left to ponder Qualcomm's expanding influence in technology's most dynamic arenas.