Qualcomm's Financial Fortitude in Q3 FY2025

Highlights

- Revenue: $10.4B, non-GAAP EPS: $2.77

- QCT revenue: $9B (+11% YoY), EBT: $2.7B (+22% YoY)

- QCT IoT revenue: $1.7B (+24% YoY)

- Automotive revenue: $984M (+21% YoY)

- Licensing revenue: $1.3B

- Returned $3.8B to stockholders

- Snapdragon-based PCs: 9% of Windows laptops sold over $600

Qualcomm delivered another robust quarter, demonstrating remarkable resilience and adaptability despite the global economic challenges. For the third fiscal quarter of 2025, Qualcomm reported $10.4 billion in revenues, with non-GAAP earnings per share at $2.77, both figures firmly near the upper echelon of the company's guidance range.

Strength in Automotive and IoT

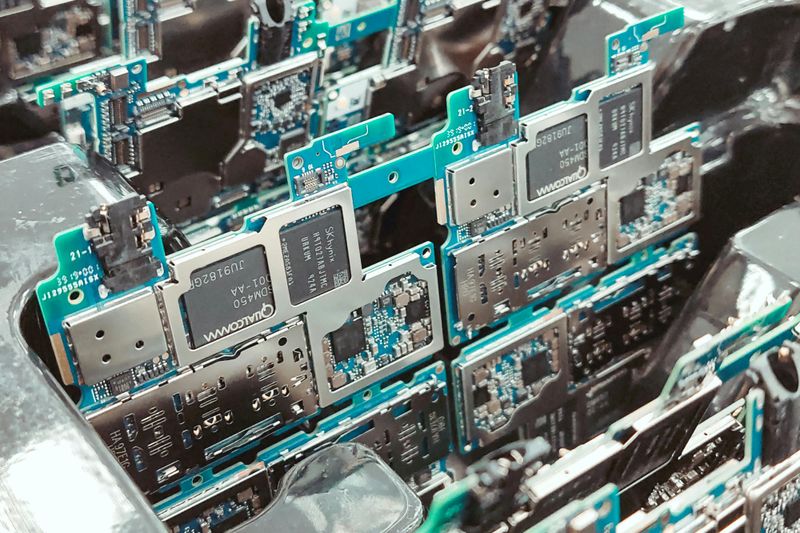

A prominent highlight was the chipset business, which accounted for $9 billion in revenues, marking an 11% increase year-over-year. Notably, the IoT segment shone brightly with a 24% jump, bringing in $1.7 billion. Likewise, the automotive sector sustained its impressive upward trajectory, generating $984 million — a 21% rise, driven by the successful integration of Qualcomm’s Snapdragon Digital Chassis. Qualcomm’s automotive and IoT ambitions remain unwavering, targeting $22 billion in revenues by fiscal 2029.

Expanding Horizons

Licensing also contributed significantly with $1.3 billion in revenues. Meanwhile, Qualcomm is setting its sights on diversifying beyond traditional domains, with Snapdragon now forming 9% of Windows laptops sold over $600 in the U.S. and major European markets.

Amidst these expansions, Qualcomm made strides in the data center sector, enhanced by its strategic move to acquire Alphawave IP Group for further strengthening its custom system-on-chip (SoC) offerings. This acquisition is anticipated to close in early 2026.

Shareholder Returns

Consistent with its commitment to shareholders, Qualcomm returned an impressive $3.8 billion through dividends and stock repurchases, illustrating its firm dedication to maximizing shareholder value.

Overall, Qualcomm continues to navigate with precision, reinforcing its position not only in the handset market but advancing strongly in automotive, IoT, and other burgeoning areas, all whilst maintaining robust financial health. Investors will find Qualcomm’s prudent operational strategies reveal a portrait of resilience and innovation in a rapidly shifting tech landscape.