Qualcomm's Latest Earnings Reflect Strong Growth Amid Evolving Tech Trends

Highlights

- Non-GAAP revenues: $10.8 billion

- Non-GAAP earnings per share: $2.85

- Chipset business revenue: $9.5 billion

- Automotive segment growth: 59% YoY

- IoT segment growth: 27% YoY

- Automotive revenue target: $8 billion by 2029

- Non-handset revenue target: $22 billion by 2029

- PC market target revenue: $4 billion by 2029

- PCs on Snapdragon expected market share: 9% in higher-end Windows laptops

- Third fiscal quarter revenue forecast: $9.9 to $10.7 billion

- Plan to return 100% of free cash flow to shareholders in fiscal 2025

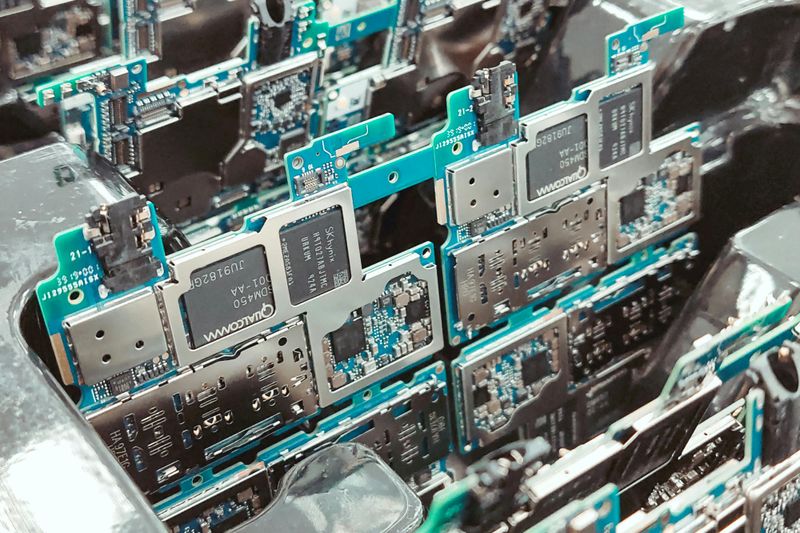

In an era where artificial intelligence (AI) and technology rapidly evolve to meet the needs of both consumers and industries, Qualcomm demonstrates its steadfast foothold across diverse markets through its robust second-quarter fiscal 2025 earnings.

Impressive Financial Performance

Qualcomm reported non-GAAP revenues of $10.8 billion for the quarter, alongside an impressive non-GAAP earnings per share of $2.85—exceeding its past guidance. These figures underscore the effectiveness of Qualcomm's strategy in diversifying its revenue streams, particularly via its chipset business which accounted for $9.5 billion of these revenues. Notably, strong performance across Handsets, Automotive, and IoT has driven these results, with the Automotive and IoT segments experiencing substantial growth of 59% and 27% year-over-year, respectively.

Qualcomm’s Strategic Vision

Christiano Amon, Qualcomm’s President and CEO, delineated the company’s strategic vision which prominently features the evolution and proliferation of AI across industries. Qualcomm’s dedication to spearheading the next wave of AI smartphone innovation remains unwavering, with an ambition to grow non-handset revenues to $22 billion by the fiscal year 2029. The company's pivotal role in the burgeoning landscape of AI, illustrated by their Snapdragon platforms hosting newer AI models, indicates the expanding frontier of Qualcomm's technology leadership.

Advancements Across Qualcomm’s Core Businesses

Mobile Technology

Qualcomm made considerable advances in mobile technology with the introduction of the X85 5G platform. This system showcases substantial enhancements in speed, coverage, and efficiency, reinforcing Qualcomm's commitment to delivering unrivaled connectivity solutions. The exclusive availability of this platform on Android devices further cements Qualcomm's leadership within the Android ecosystem.

Automotive Prospects

Automotive emerged as a highly promising avenue, emphasized by the adoption of Qualcomm’s Snapdragon Digital Chassis platforms in newly launched vehicles and the securing of multiple new design wins. Looking forward, Qualcomm maintains its revenue target of $8 billion in automotive by 2029, fortified by partnerships that innovate AI-powered automotive solutions.

IoT and PCs

Qualcomm's IoT business showed a 27% year-over-year increase in revenues, supported by strategic acquisitions to augment its industrial IoT capabilities. Moreover, within the PC market, Qualcomm is leveraging its Snapdragon platforms to capture a larger share, targeting $4 billion in revenues by fiscal 2029. With PCs running on Snapdragon expected to reach a 9% market share in higher-end Windows laptops, the outlook remains positive.

Financial Guidance and Market Conditions

For the third fiscal quarter, Qualcomm forecasts revenues between $9.9 billion and $10.7 billion. This guidance signifies careful consideration of macroeconomic uncertainties, including deduced impacts from prevailing tariffs. Despite these external pressures, Qualcomm underscores the stability of its diversified global supply chain, positioning itself resiliently against potential market disruptions.

Capital Returns and Strategic Investments

Reflecting confidence in enduring cash flow generation and strategic deftness, Qualcomm plans to return 100% of free cash flow to its shareholders throughout fiscal 2025. The company's prudent capital allocation strategy stands out as a testament to its financial robustness and operational discipline amidst evolving market landscapes.

Navigating Future Prospects

Qualcomm’s strategic initiatives aim squarely at reinforcing its technological dominance and capitalizing on new market opportunities. As new AI innovations unfold, the potential for increased chipset content and expanded market share surges, potentially translating to substantial long-term growth. Qualcomm’s entries into burgeoning sectors like automotive and XR (extended reality) further suggest vast untapped potential.

In conclusion, Qualcomm’s second-quarter earnings encapsulate a narrative of strategic evolution and operational excellence. The company maintains its stance of being an innovator deeply embedded in the fabric of an AI-driven future, poised to capture significant value across its diversified portfolio as global technological advances progress.