Qualcomm's Record-Breaking Quarter: A Closer Look

Highlights

- Record revenues: $11.7 billion

- Non-GAAP earnings per share: $3.41

- Chipset Business (QCT) revenue: $10.1 billion

- Licensing revenues: $1.5 billion

- Automotive revenues increase: 61% YoY

- IoT revenues increase: 36% YoY

- Over 10% share in the premium US retail laptop market

- Projected non-handset revenue: $22 billion by 2029

The release of Qualcomm's fiscal first-quarter earnings for 2025 has captured the attention of retail investors and industry enthusiasts alike. The company, known for its innovative advancements in the semiconductor industry, reported impressive financial figures and strategic developments. This article delves into Qualcomm's latest accomplishments and offers insights into what might lie ahead for the tech giant.

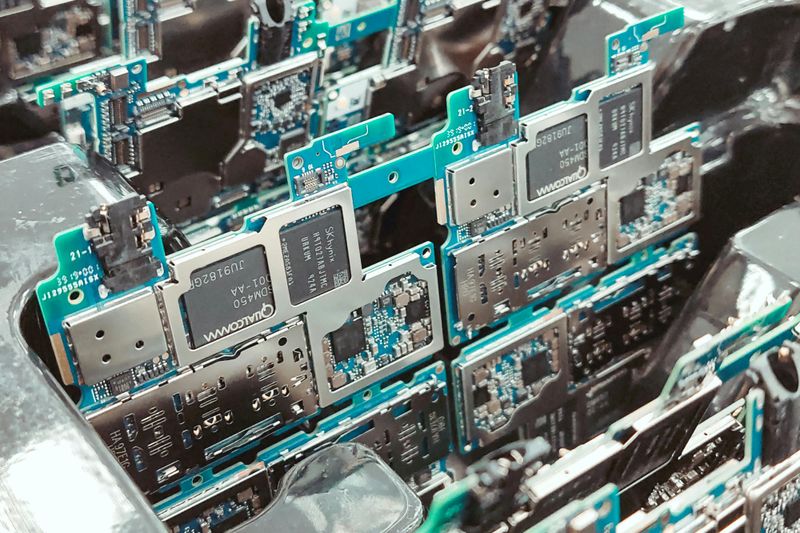

Driving Forces Behind Qualcomm's Record Quarter

Financial Achievements:

- Qualcomm reported record revenues of $11.7 billion, with a non-GAAP earnings per share of $3.41.

- The Chipset Business (QCT) generated a groundbreaking $10.1 billion, marking its first $10 billion quarter.

- Licensing revenues reached $1.5 billion.

Qualcomm's President and CEO, Cristiano Amon, articulated the company's successful start to fiscal 2025, attributing these accomplishments to strong demand across the mobile, automotive, and IoT segments.

Expansion and Innovation: Key Growth Areas

Mobile Market Focus:

- The recently launched Samsung Galaxy S25 series, powered globally by Snapdragon 8 Elite, highlights Qualcomm's significant foothold in premium smartphones.

- AI features in smartphones indicate a shift towards on-device processing, as seen with the Snapdragon's capabilities for Google Gemini and Galaxy AI integrations.

Automotive and IoT:

- Automotive revenues surged by 61%, and IoT by 36%, compared to last year.

- Innovations like industrial IoT solutions and AI-focused platforms continue to foster growth and diversify revenue streams.

PC Market Potential:

- Qualcomm's penetration into PCs has seen positive momentum with the Snapdragon X series, boasting features like extended battery life and strong AI capabilities. The company reported over 10% share in the premium US retail laptop market.

Strategic Collaborations and Developments

Qualcomm's partnerships play a crucial role in its sustained growth. Noteworthy collaborations include:

- Automotive Ventures: Collaborations with automotive giants such as Hyundai Mobis and Leapmotor for AI-powered systems are expected to enhance user experiences and maintain Qualcomm's leadership in software-defined vehicles.

- Extended Licensing Agreements: Successful negotiations have secured long-term commitments from major OEMs like Transsion, which bolster Qualcomm's licensing revenues consistently.

Outlook and Challenges

Future Projections:

- Qualcomm is maintaining its guidance for QTL revenues to be consistent with fiscal 2024.

- The firm anticipates $22 billion in non-handset revenue by 2029, underscoring Qualcomm's long-term vision to diversify beyond mobile technologies.

Potential Upsides:

- Qualcomm may benefit from untapped potential in the Chinese market, particularly if consumer response to recent subsidies propels demand.

Huawei Licensing Ambiguity:

- Current forecasts do not account for renewed agreements with Huawei, representing a potential upside not factored into the year-end projections.

The Bottom Line

Qualcomm's fiscal first quarter of 2025 reflects robust growth across multiple business units, powered by strategic collaborations and cutting-edge technological innovations. As on-device AI becomes increasingly prevalent, Qualcomm appears well-positioned to capitalize on emerging trends. Retail investors will undoubtedly watch closely how Qualcomm navigates remaining uncertainties and seizes new opportunities in the ever-evolving tech landscape.